From a home loan point of view, small increases in basis points can indicate larger modifications in the interest rate you could pay. The lender as well as the marketplace identify your price decrease, and also it can alter after the fixed-rate duration for your mortgage finishes. That's why it's important to see to it your break-even factor happens well prior to the fixed-rate runs out. For Financial institution of America clients, nevertheless, if rates increase throughout the adjustable period, your rate will certainly be reduced based upon the factors you originally purchased. If you have an adjustable rate home loan, your repayment may boost at modification dates, since your rates of interest might boost by some basis points. Ought to your rates of interest boost by 25, 50 or 100 basis factors, it's less complicated to just state the increase in regards to a quarter, half or 1 percent.

Where you begin with a fixed or flexible low initial payment period during which you're only paying off rate of interest from your finance. Hereafter duration is over, you'll require to make larger settlements that integrate the principal balance. At the very same time, the price can't be too expensive due to the fact that you need to be competitive with the rest of the market. Basis points work as systems of comparison for different financial tools. They show the change or difference within and also across various funds or car loans.

- Comparing different financings with varying interest rates, lending institution costs, origination fees, discount rate factors, and also origination factors can be really challenging.

- The most typical cost is 1%, though the maximum car loan origination cost is 3% on Qualified Home mortgages of $100,000 or even more.

- She has been an investor, entrepreneur, and consultant for more than 25 years.

So if you got a mortgage rate quote of four percent one week and it changed to 4.25 percent the following week, that suggests it increased by 25 basis factors. If you have a present duplicate of your individual credit scores record, merely get in the report number where shown, and also comply get more info with the directions provided. If you do not have an existing personal record, Experian will supply a totally free duplicate when you send the info asked for. Furthermore, you may get a cost-free copy of your report once a week through April 2022 at AnnualCreditReport. No matter the basis factors or the kind of car loan, you ought to inspect your cost-free Experian credit history report and complimentary Experian credit score before you shop for a home mortgage.

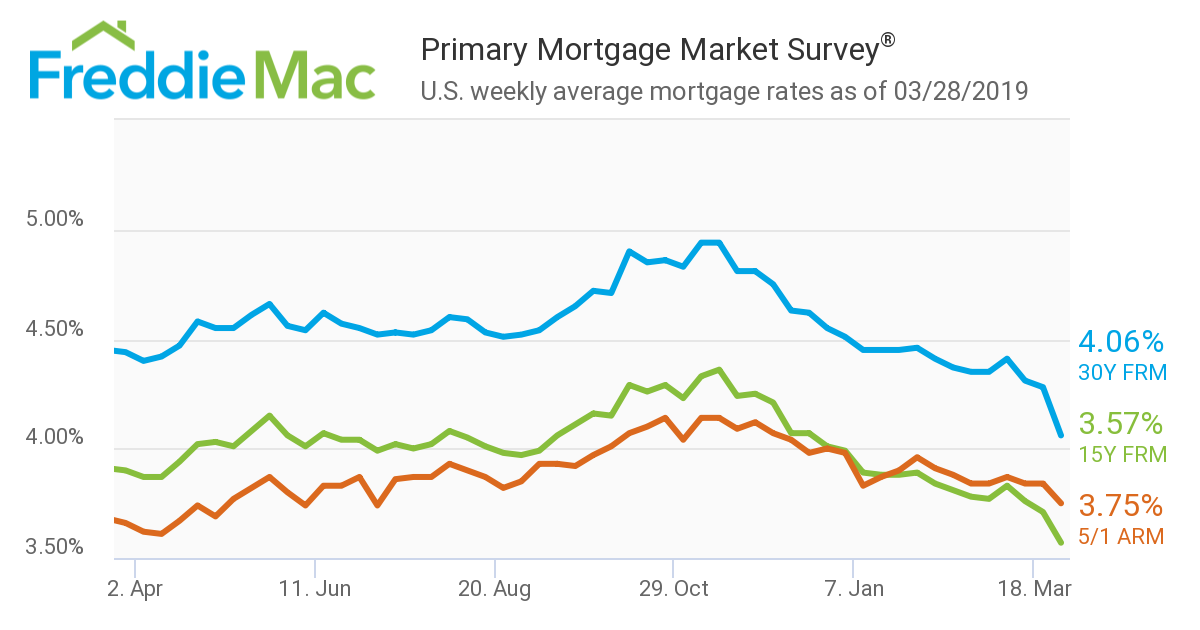

Weekly Rate Watch: Ordinary 2

This implies that it will certainly cost you one-half of 1 percent of your mortgage loan balance to lock your rate for 60 days. As described, a basis point represents 1/100th of a percentage point. By comparison, one price cut point amounts to 1% of the finance amount. For instance, one point on a $200,000 mortgage https://a.8b.com/ would work out to $2,000. When you take out a mortgage, you can purchase Go to this website discount points to minimize the rate of interest over the life of the finance.

Exactly How To Figure Mortgage Rates Of Interest & Settlements

Mortgage basis factors impact the rates of interest you pay, where one basis factor amounts to 0.01 percent in interest. We strive to provide you with details concerning services and products you might locate fascinating and beneficial. Relationship-based ads as well as on the internet behavioral advertising assist us do that.

The collection portion points the loan provider contributes to the index rate when changing a rate of interest on an adjustable price home mortgage. A home loan program funded by the state, with recommended rates and charge discounts geared for Hawaii citizens acquiring a main house for the first time. The gradual settlement of a monetary obligation on an installment basis such that at the end of the given car loan term, a specified equilibrium is paid. Smallest measure made use of in estimating returns on expenses, notes, and bonds.